The Effective Annual Rate of Interest Is Quizlet

What is the effective annual interest rate of an investment that pays 76 annual interest compounded quarterly. So although Bank B may have a slightly higher nominal interest rate it has a lower EAR than Bank A because it compounds fewer times over the course of the year.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

M is the number of compounding periods per year.

. Calculate and interpret the effective annual rate given the stated annual interest rate and the frequency of compounding. What is the effective annual rate associated with an 8 nominal annual rate r 008 when interest is compounded 1 annually. He put down 6000 and financed the rest through the dealer at an APR of 49 percent for four years.

Thats the same as an annual interest rate of10 when expressed as a decimal. With continuous compounding the effective annual rate calculator uses the formula. The stated annual interest rate on bonds.

Effective annual interest rate. The rate of interest that will produce the same future value of cash using. Nominal interest rate is 10 percent.

That difference of 038 may appear insignificant but it can be huge. The EAR is the simple interest charged per period multiplied by the number of periods per year. The effective annual interest rate EAR is defined as the annual growth rates that do not take compounding into account.

Therefore EAR 10361212 1 04257 or 4257. To calculate the effective annual interest rate of a credit card with an annual rate of 36 and interest charged monthly. 1036 1 101 2 x 2 1.

Effective annual interest rate bartleby. Why Dont Banks Use the Effective Annual Interest Rate. If the effective annual rate of interest is known to.

1047 1 10 12 x 12 1. Add 1 to that to get 10083333333. Effective interest rate for t periods it1it1.

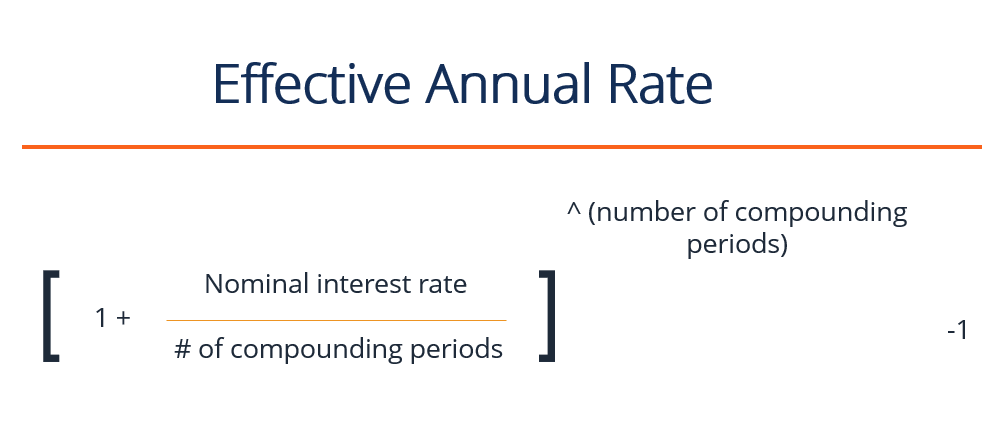

Effective Annual Interest Rate i 1 rn n 1. Start studying Chapter 5 - Effective Annual Interest Rate. Experts are tested by Chegg as specialists in their subject area.

Commonly a period will be a year but it can be any time interval you want as long as all inputs are consistent. We review their content and use your feedback to keep the quality high. Learn vocabulary terms and more with flashcards games and other study tools.

Answer in percentage round it to 2 numbers after the decimal point. So although the stated annual interest rate is 10 because of quarterly compounding the effective rate of return is 1038. Marshell Chavez bought a Honda Civic for 17345.

Round to the nearest hundredth of a percent. The Effective Annual Rate Calculator uses the following formula. 151 9 APR 11608 025 1 4 APR 01519 or 1519 AACSB.

Effective annual interest rate 1 nominal rate number of compounding periods number of compounding periods - 1. Investment B has a higher. The EAR is the interest rate actually paid or earned after accounting for compounding.

Where i is the effective annual interest rate expressed as a decimal r is the nominal interest rate expressed as a decimal n is the number of payments per year. For Bank B this would be. As a result the effective interest rate will be more than the annual rate.

A credit card that charges a monthly interest rate of 3 has an effective annual interest rate of. The following practice questions require you to calculate the effective rate of loans where the interest is compounded quarterly. Who are the experts.

For Bank A this would be. 145 0 D. 40 2 B.

If the effective annual rate of interest is known to be 1608 on a debt that has quarterly payments what is the annual percentage rate. I 1 r m m 1. The procees of paying interest on prior intereest of an investment.

100 2 C. Analytical Thinking Accessibility. To get the effective annual rate you do the following.

Effective Interest Rate Formula i1rmm1. Borrows 45000 from the bank for one year at. Where r R100 and i I100.

EAR 1 01 22 1 10052 1 1025 E A R 1 01 2 2 1 1 005 2 1 1025. Lastly we calculate the PV. Divide that by 12 to get a monthly interest rate of 10083333.

As you will recall the PV formula is. The formula and calculations are as follows. The effective annual rate is the actual interest rate for a year.

See the answer See the answer done loading. Substituting the first equation into i in the second equation. Finance questions and answers.

R and i are interest rates in decimal form. When the interest on a loan is calculated in advance and subtracted from the proceeds of the loan. Number of compounding periods.

Practice questions Use the following information to answer the questions.

Nominal And Effective Interest Rates Flashcards Quizlet

Effective Annual Rate Definition Formula What You Need To Know

Comments

Post a Comment